State Sen. Joe Fain, R-Auburn, 47th District, issued the following article about changes to the the property tax system as part of his legislative email updates:

In recent weeks you may have seen news stories about property taxes going up, with some attributing the increase to changes made last year in the Legislature. While that’s partially the case, the overall increase is actually due to a variety of factors including a state rate increase, local voter-approved levies and increasing home values throughout the region.

What hasn’t been as widely discussed is how much of that 2018 property tax increase is actually attributable to funding for public schools as well as what will actually be an overall tax decrease for many going into effect next year.

To understand the complicated world of property taxes and education funding I’ve broken down how it works for this week’s email update.

And not to spoil the ending, but we’re in great position to do away with the one-year tax increase thanks to our state’s strong economic growth.

What is happening?

The overwhelming majority of funding for Washington’s public schools comes from the state budget and local “maintenance and operations” levies.

While both of these items appear on your property tax statement, your overall bill is made up of many smaller components, which differ depending on the city and county you live in along with a variety of other taxing districts.

Part of last year’s education funding reforms included an increase in the state property tax rate for education by $0.81/$1,000 of assessed property value. Because this is a statewide change every property sees an increase. Further complicating this topic, the actual rate varies slightly in each of Washington’s 39 counties as different assessors means different methodologies. The state rate is then adjusted as needed to ensure properties are being assessed at full value. In King County, this actually means a net $0.88 rate increase from 2017 to 2018.

But what has been less discussed is how much the increase in the state rate factors into your overall property tax bill. In some school districts, it makes up most, and in others very little.

To get a better sense we’ll take a deeper look at how this plays out in Auburn.

SENATOR’S NOTE: I chose Auburn because the change in property tax rate is in the middle of the pack for South King County with some lower (Covington, Renton) some higher (Kent, Enumclaw) and others close to the same (Federal Way).

Property taxes for the median value home in Auburn are $403 higher in 2018 than in 2017.

Of that total $322 is attributable to changes in education funding, but it’s not actually that simple. The $322 also reflects the fact that the median value home increased significantly from $277,000 in 2017 to $304,000 in 2018. That means $243 of the overall increase is actually attributable to the increased state rate, with the rest a result of the home being worth more than the previous year.

That means roughly 60 percent of the overall property tax increase in Auburn is a result of the increased state property tax rate.

However, another key component of our property tax reform has gone under the radar. Beginning in 2019 the Legislature capped local maintenance and operations levies at $1.50/$1,000 of assessed value, which will lead to a tax reduction in Auburn, Kent, Federal Way, Covington and other South King Community communities starting next year.

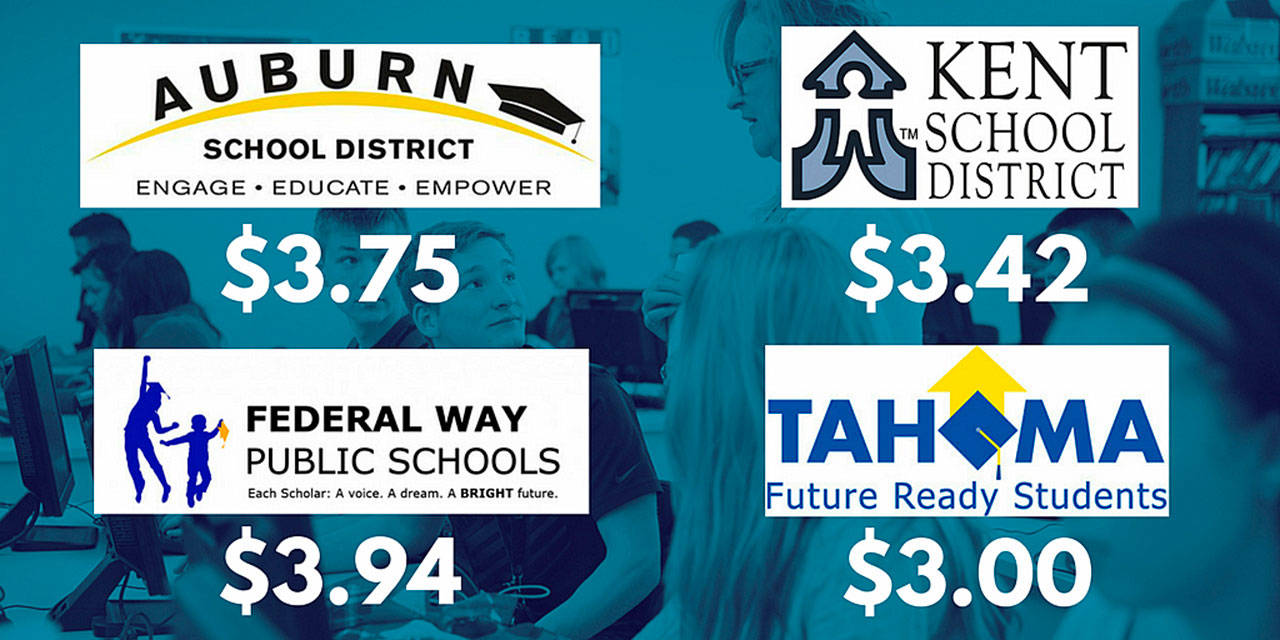

The 2017 local levy rates for schools in our community (seen below) would all go down to a maximum of $1.50, meaning a tax cut even after including the increased state rate.

The actual dollar amount will vary depending on future home valuations, but if the median value home in Auburn increased by 5 percent in 2019, as projected by budget staff, the owner of a median value home in Auburn would still see a $200 tax cut over what they paid in 2017. This would be carried out beyond 2019 into 2020 and 2021.

We can still do more

While South King County taxpayers will see a property tax cut starting in 2019, I’m still not a fan of the one-year property tax increase in 2018.

However, we have a way to fix that, which I co-sponsored and have been working on this year.

The two-year state budget we approved in June 2017 projects to balance for four years. Since then we’ve received good economic news.

Based on our third and fourth quarter 2017 revenue forecasts we’re already officially projected to take in $1 billion in additional revenue due to strong economic growth.

We also received news last week that the projected demand for services is actually lower than anticipated, which reduces spending already approved in the budget by $225 million. Furthermore, on Thursday (Feb. 15) we will get our first quarter 2018 revenue forecast, which is expected to be even higher based on previous month’s actual revenue collections.

All told we could be looking at almost $2 billion in additional resources, beyond what is necessary to sustain an already robust state budget. This would allow us to reduce the one-year increase in property taxes while continuing to make a historic investment in our state’s public schools.

NOTE: The 47th District includes all of Covington and parts of Auburn, Kent, Federal Way and Renton.