Everyone agrees that the patient is sick.

But it is hardly a secret that hot disagreements rage over the federal deficit and what to do about it.

Arguing that the federal government has a spending problem, Republicans urge deep cuts. Democrats say no, the government has a revenue problem and urge tax increases on the wealthiest Americans.

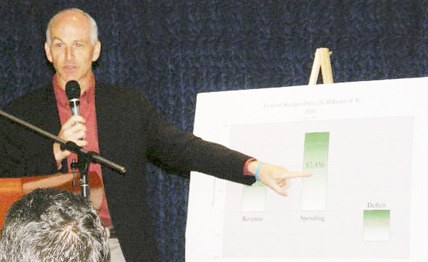

During an appearance before the April 18 Chamber Partnership Luncheon at Emerald Downs, U.S. Congressman Adam Smith from Washington’s 9th Congressional District pressed for a pragmatic solution that sets aside ideologies and politics.

“The main thing you thing need to know is that we have both a spending and a revenue problem,” Smith said. “Both of these things are a problem that has been developing over the course 10 20, and in some cases more of those years.”

Any solution, Smith said, must combine spending cuts and tax increases. And there will be no overnight solution.

Smith noted the government right now spends 33 percent more than what it takes in. That can’t go on, he said.

In order to fill gap, Smith said, the federal government would have to cut 33 percent out of everything it now spends, putting aside the problem of revenue. In recent wrangling over the $3.6 trillion 2011 federal budget, lawmakers set aside $2.6 trillion as untouchable, leaving $1 trillion of so-called discretionary spending to cut.

“We could cut all of that, and we would still be in debt. We’ve got to put the whole thing on the table,” Smith said, including defense spending, Social Security, Medicare, Medicaid, unemployment, and retirement pay for all federal employees and more.

“If we cut a third out of Medicare, a third out of Medicaid, a third out of Social Security, that has an impact. That’s a great frustrations of mine. A lot of people say, ‘It wouldn’t matter, it doesn’t impact us.’ No, it has a profound impact on people. A front-page story in the Seattle Times this morning said something like ‘Cuts in Medicaid may have a real impact.’ May? No, they are going to have an impact. The money goes to somebody who gets something out of it.”

So much for the spending picture.

In 2000, Smith said, revenue as a percentage of GDP was 21 percent, which is a common way to measure whether revenue or spending is going up, because it is adjusted to how much the overall economy is making. By 2010, revenue as a percentage of GDP was 15 percent. That means government revenue has dropped 30 percent at the same that spending has nearly doubled, Smith said.

Smith added that given the many write-offs and tax deductions in the tax code, people are paying lower and lower taxes because they are getting better at taking advantage of the write-offs.

“If you double your spending and cut revenue by 30 percent, you are going to have a problem, and you have to turn that around,” Smith said

While the average voter typically recognizes the deficit as a massive problem that must be dealt with, Smith said, that same voter doesn’t want tax increases, cuts to Social Security, Medicare or Medicaid, or defense spending, either.

“What the typical voter is saying is get the deficit under control, but don’t touch this and that, so take half off the table, and by the way, don’t bring in any more revenue,” Smith said. “That’s impossible; it can’t be done. At that point, you simply have to make a choice of which of those things you want to do.

I’m wide open to suggestions, but the suggestion that we should not increase revenue, we should not touch Social Security and Medicare and we should balance the budget is a non-starter because it’s impossible. In my personal opinion, we’ve got to do everything.

“Number one is get more revenue coming in. There are like 45 percent of American people don’t pay any federal taxes on this side. You also have the case of GE and other companies that have figured out how to make $10 billion and pay nothing in federal taxes,” said Smith, urging an end to the many write-offs and tax breaks written into the tax code.